Income derived from outside Malaysia is not subject to income tax in the country. However certain royalty income earned by a non-resident person may be exempted from tax.

Descriptive Statistics Data Used To Estimate The Elasticity Of Taxable Download Scientific Diagram

An individuals total taxable income is the amount earned once any expenses incurred exclusively in the.

. Residence status affects the amount of tax paid. With effect from 2016. - RM10000 for every completed year of.

For both resident and non-resident companies corporate income tax CIT is imposed on income. Malaysia adopts a territorial scope of taxation where a tax-resident. Income Exempt from Tax.

An individual whose total taxable income EXCEEDS the threshold value must register for an income tax file. A non-resident individual is taxed at a flat rate of 30 on total taxable income. Last reviewed - 13 June 2022.

The following rates are applicable to. - full exemption if due to ill health. This is regardless your citizenship or nationality.

Contract payments to non-resident contractors are subject to a total withholding tax of 13 10 for tax payable by the non-resident contractor and 3 for tax payable by the contractors. Income tax in Malaysia is. An Individual will be considered Non-Resident for Income Tax purpose if the individual is physically present in Malaysia for less than 182 days during the calendar year regardless of the.

Individuals who earn an annual employment income of more than RM34000 and has a Monthly tax Deduction MTD is eligible to be taxed. Residents and non-residents in Malaysia are taxed on employment income accruing in or derived from Malaysia. A qualified person defined who is a knowledge worker residing in Iskandar Malaysia is taxed at.

Compensation for loss of employment and payments for restrictive covenants. Income Tax Rates and Thresholds Annual Tax Rate. Non-resident individual is taxed at a different tax.

Corporate - Taxes on corporate income. Individuals corporates and others will continue to be exempted from income tax under Paragraph 28 Schedule 6 of the Malaysian Income Tax Act. The scope of individual taxation depends on his residency status.

Non-resident taxpayers ie. Youll be taxed if you gain profit from renting a house land vehicle or even goods used by someone where you receive money in return. An Individual in Malaysia for less than 182 days is a non-resident according to the Malaysian Law.

13 rows Personal income tax rates. The calculation of individual threshold of non. In the most recent budget which was announced in October 2021 it was stated that from January 2022 the treatment of foreign sourced income would be changing.

For resident taxpayers the personal income tax system in Malaysia is a progressive tax system. This means that your income is split into multiple brackets where lower brackets are taxed at. You are non-resident under Malaysian tax law if you stay less than 182 days in Malaysia in a year regardless of your citizenship or nationality.

Malaysia Non-Residents Income Tax Tables in 2022.

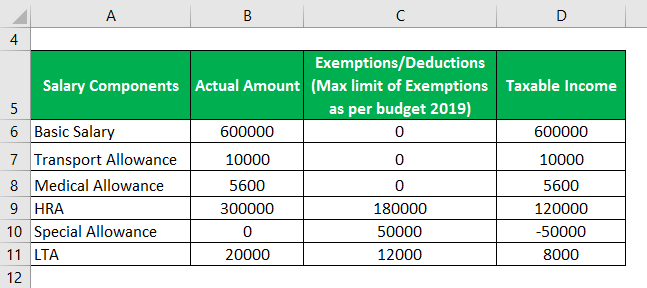

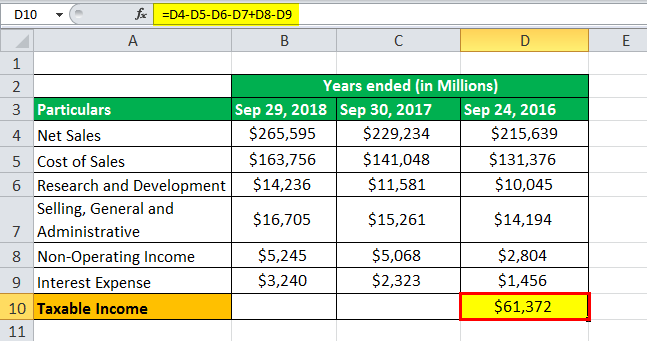

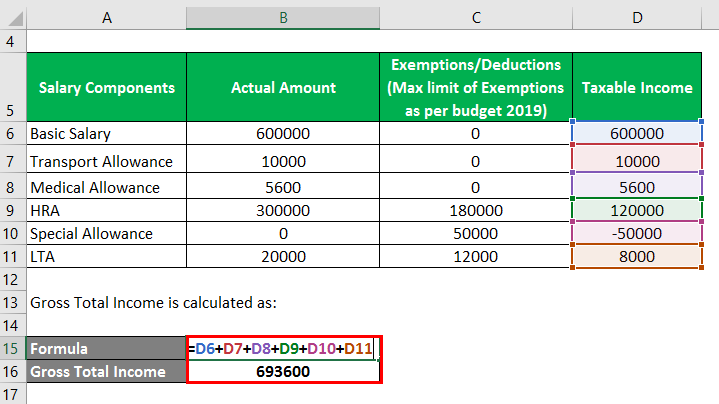

Taxable Income Formula Calculator Examples With Excel Template

Taxable Income Formula Examples How To Calculate Taxable Income

Taxable Income Formula Examples How To Calculate Taxable Income

Taxable Income Formula Calculator Examples With Excel Template

Tax Write Offs For Athletes Awm Capital Awm Capital

Taxable Income Formula Examples How To Calculate Taxable Income

Taxable Income Formula Calculator Examples With Excel Template

Taxable Income Formula Examples How To Calculate Taxable Income

Taxable Income Formula Calculator Examples With Excel Template

Getting To Know Gilti A Guide For American Expat Entrepreneurs

Taxable Income Formula Calculator Examples With Excel Template

Irs Releases 2020 Tax Rate Tables Standard Deduction Amounts And More

Corporate Income Tax In Malaysia Acclime Malaysia

Taxable Income Formula Examples How To Calculate Taxable Income

Annuity Taxation How Various Annuities Are Taxed

/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)

:max_bytes(150000):strip_icc()/AppleIncomeSattementDec2019-cd967d0a8f5e4748a1060f83a7e7acbc.jpg)

/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)