Electronic submission e-Payment ready. Single Married filing jointly.

How To Step By Step Income Tax E Filing Guide Imoney

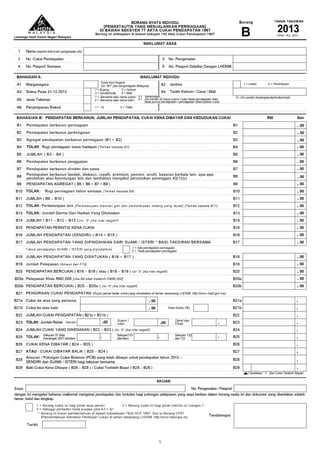

MAKLUMAT PERTUKARAN ALAMAT CHANGES IN ADDRESS B1 Alamat surat-menyurat Correspondence address Poskod Postcode Bandar.

. Maybank CIMB HLBB Public Bank. Latest income tax notice of assessment or latest 6 months CPF Contribution history statement. Married filing separately MFS Head of household HOH Qualifying widower QW.

Department of the TreasuryInternal Revenue Service. For Existing Standard Chartered Credit Cardholders. The income tax relief of RM6000 for a disabled individual is.

Terima kasih sbb post ni sangat membantu as tutorial utk sy yg noob psl income tax. For ease of filing you can use ezHasil to file your taxes online. Lembaga Hasil Dalam Negeri Malaysia HASiL ingin memberikan peringatan kepada semua pembayar cukai yang tidak menjalankan perniagaan agar segera melaporkan pendapatan mereka yang layak.

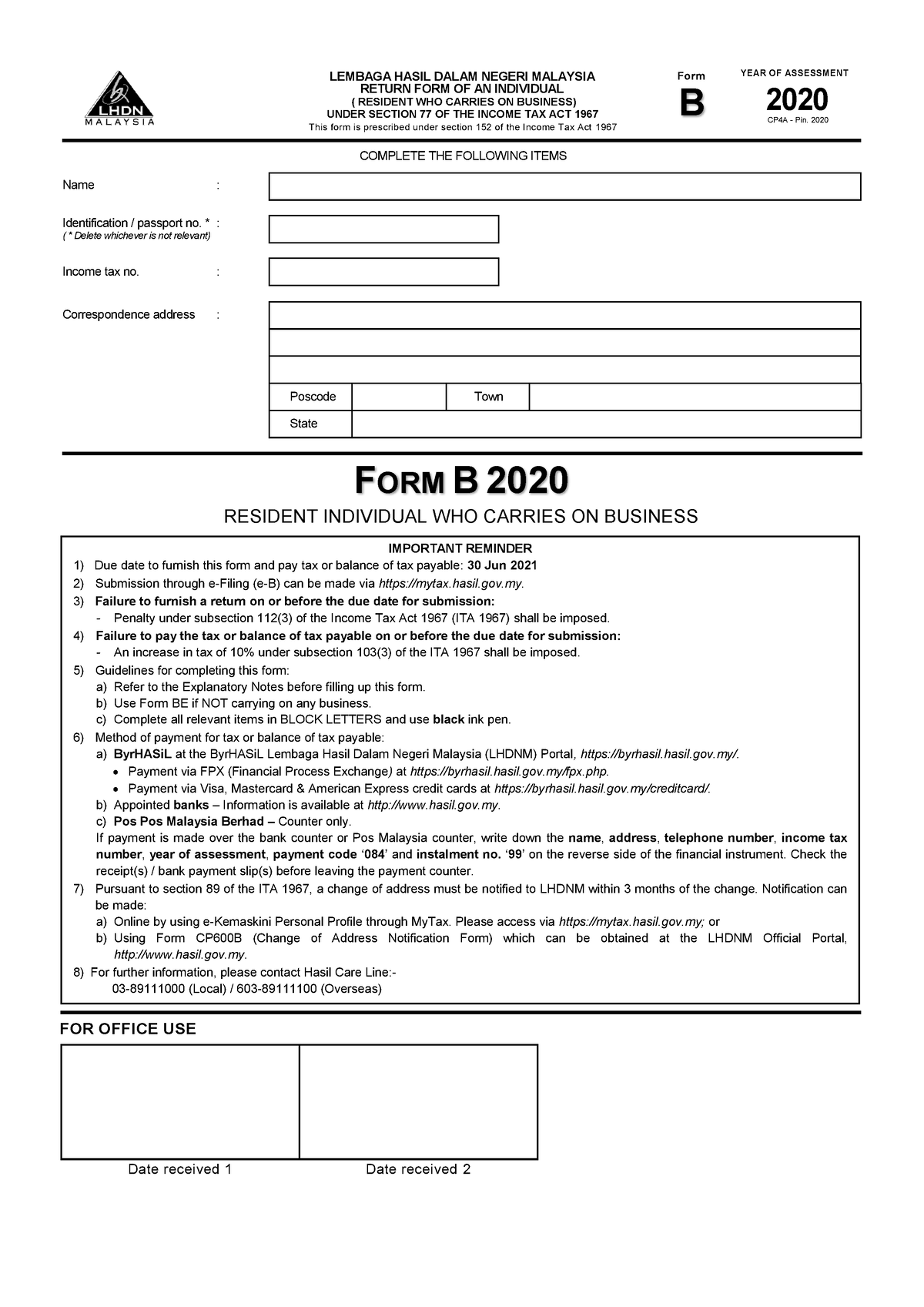

Apa beza Borang BE dan Borang B. Anda nak tengok Borang BEB 2021. Individual Income Tax Return.

Borang BBE with LHDN Acknowledgement Receipt. You must pay income tax on all types of income including income from your business or profession employment dividends interest discounts rent royalties premiums pensions annuities and others. LAPORKAN PENDAPATAN TAHUN TAKSIRAN 2021 SELEWAT-LEWATNYA PADA 15 MEI 2022 DAN ELAK PENALTI LEWAT KEMUKA BORANG NYATA CUKAI.

Check only one box. How to use investment to claim more Malaysian income tax relief. July 2021 Amended US.

Borang B 2019. Have a nice day. PART B.

Federal means-tested public benefits include food stamps Medicaid Supplemental Security Income SSI Temporary Assistance for Needy Families TANF and the State Child Health Insurance Program SCHIP. State Means-Tested Public Benefits Each state will determine which if any of its public benefits are means-tested. SQL Payroll software is ready to use with minimal setup for all companies.

How to file your income tax. BORANG PEMBERITAHUAN PERTUKARAN ALAMAT SEKSYEN 89 AKTA CUKAI PENDAPATAN 1967 SEKSYEN 37 AKTA PETROLEUM CUKAI PENDAPATAN 1967. What tax exemption or deductions are foreigners entitled to.

Form W-9 officially the Request for Taxpayer Identification Number and Certification is used in the United States income tax system by a third party who must file an information return with the Internal Revenue Service IRS. Borang BEB 2021 akan dimuat naik pada bulan Mac 2022. However you will be required to use the Form MMT Borang MMT instead of the Form BBE.

Manakala Borang B untuk individu yang mempunyai pendapatan perniagaan tak kira. Principal Card Minimum Annual Income. Non-residents filing for income tax can do so using the same method as residents.

Use this revision to amend 2019 or later tax returns. Tax borne by the employer cost of living allowance or other fixed allowances and rate of allowances-in-kind eg. No documents are required.

The number of people used in determining your deductions from income Fill in the number of people who could be claimed. Can l claim income tax relief of RM6000 under disabled individuals. Individual Income Tax Return 2021 Department of the TreasuryInternal Revenue Service 99 OMB No.

Heres a good example of an actual insurance income tax reliefs annual statement which you MUST USE to file for your Borang B or BE every year. It requests the name address and taxpayer identification information of a taxpayer in the form of a Social Security Number or Employer Identification. Cukai pendapatan Income tax no.

Borang BE untuk individu yang hanya ada pendapatan penggajian SAHAJA. Any individual earning more than RM34000 per annum or roughly RM283333 per month after EPF deductions has to register a tax file. Inclusive of KWSP SOCSO LHDN EIS HRDF EPF Borang A SOCSO Borang 8A Income Tax CP39 and Borang E ready.

SQL Payroll Software E-submission format are prepared for all banks in Malaysia. Borang E-Be hanya utk org yg tiada punca pendapatan perniagaan dan borang e-B utk org yg ada punca pendapatan perniagaan. Any individual earning more than RM34000 per annum or roughly RM283333 per month after EPF deductions has to register a tax file.

You must pay income tax on all types of income including income from your business or profession employment dividends interest discounts rent royalties premiums pensions annuities and others. IRS Use OnlyDo not write or staple in this space. B Kadar elaun tunai seperti cukai ditanggung oleh majikan elaun sara hidup atau elaun tetap yang lain dan kadar elaun berupa barangan seperti rumah kediaman pakaian dsb Monthly rate of cash allowances eg.

Whenever this part of the form refers to you it means both you and your spouse if Column B of Form 122A1 is filled in. Awak tak boleh guna borang e-Be awak kena guna borang E-B.

Borang B Atau Be Bagaimana Mengisi Borang Cukai Individu Pendapatan Bahagian 1 Borang Be Pepitih

Form E B 2020 Example Of Form E B Form B 2020 Resident Individual Who Carries On Business 20 20 Studocu

Cara Isi E Filing Lhdn Untuk 2020 2021 Panduan Lengkap

Cara Isi Borang E Filing Cukai Pendapatan Individu Borang Be B 2021

What Is Cp22 Cp22a Where To Download Cp22 Cp22a Sql Payroll

Form Be For Reference Only Pdf Lembaga Hasil Dalam Negeri Malaysia Return Form Of An Individual Resident Who Does Not Carry Business Under Section Course Hero

Personal Income Tax 2016 Guide Part 7

Business Income Tax Malaysia Deadlines For 2021

Borang B Atau Be Bagaimana Mengisi Borang Cukai Individu Pendapatan Bahagian 1 Borang Be Pepitih

Borang B Atau Be Bagaimana Mengisi Borang Cukai Individu Pendapatan Bahagian 1 Borang Be Pepitih

G G Human Resources Services What Is Form Cp22 Form Cp22 Is A Government Report That Is Issued By The Lhdn Cp22 Is A Notification Of New Employee Form An

My First Time With Income Tax E Filing For Lhdn Namran Hussin

What Is Borang E Every Company Needs To Submit Borang E Now Updated 12 3 2020 Tax Updates Budget Business News

How To File For Income Tax Online Auto Calculate For You